Asset Managers

Publish multi-media content to support:

-

Compliant dissemination of information.

-

Brand awareness through the sharing of thought leadership.

-

Investor engagement and the growth of new connections.

Private Rooms - complete control and confidentiality for:

-

Specifically selected people on an invite-only or request for access basis.

-

The sharing of information and interacting with chosen data room members.

Register as an Asset Manager

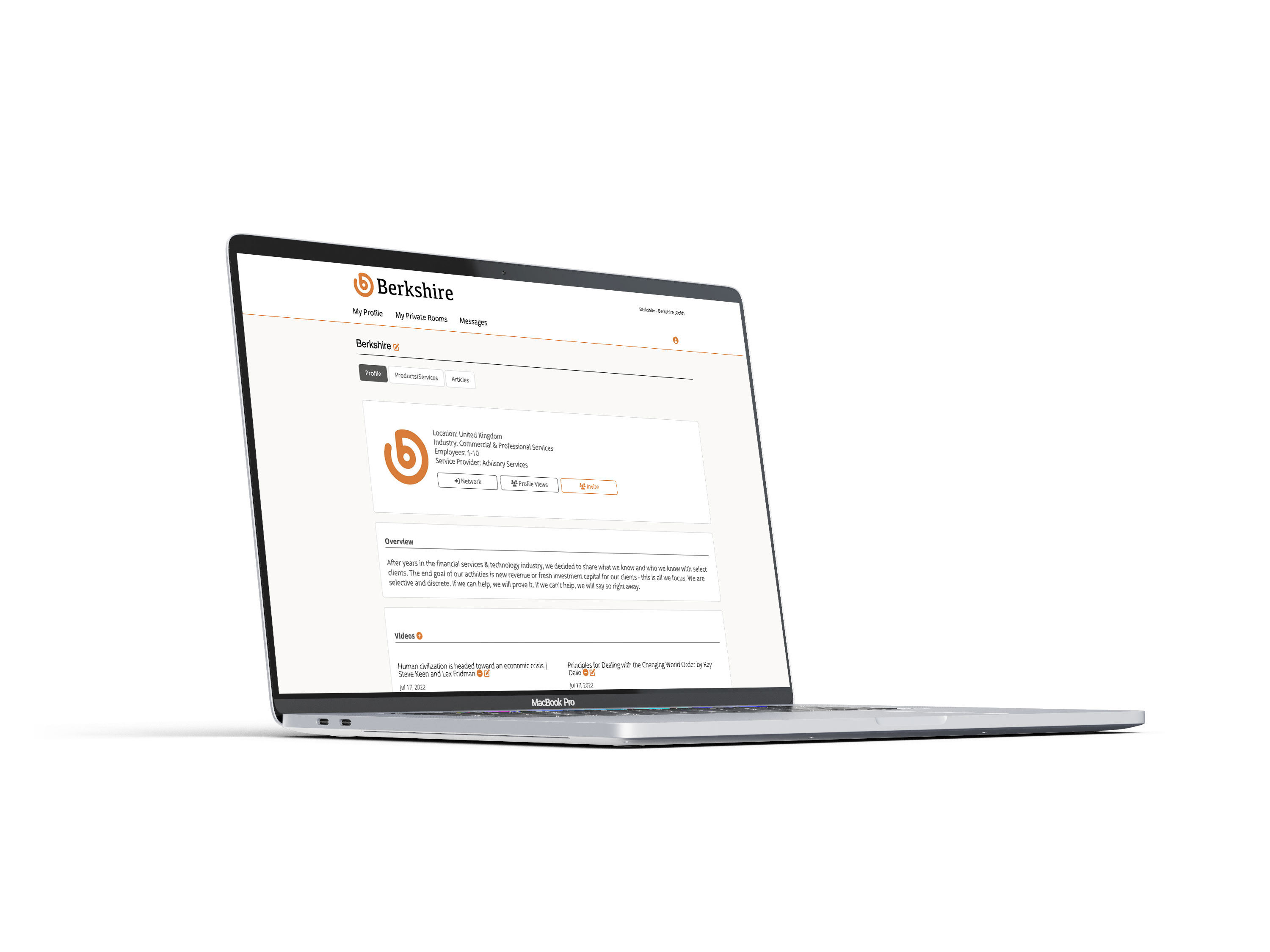

Companies

Publish multi-media content to support:

-

Brand awareness of your company and products & services.

-

Investor Relations activities including new investor networks.

-

Insights on investor activity and engagement.

Private Rooms - complete control and confidentiality for:

-

Specifically selected people on an invite-only or a request for access basis.

-

The sharing of information and interacting with chosen data room members.

Register as a Company

Investors & business professionals

Search and review Asset Manager & Company propositions confidentially

-

You cannot be searched for – you choose if you want to engage with others.

-

Watch videos, listen to podcasts and read documents on diverse sectors and people.

-

Provide commentary on company and asset managers profiles.

Your own Private Data Room - complete control and confidentiality for:

-

Specifically selected people on an invite-only or a request for access basis.

-

The sharing of information and interacting with chosen data room members.

Register as an Investor